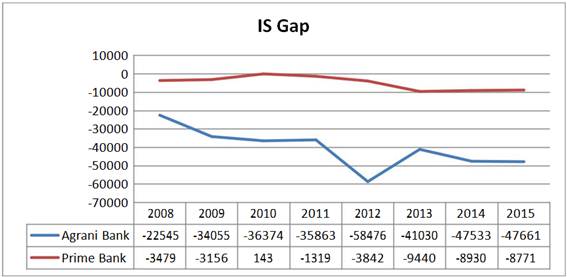

Interest Rate Risk Management of Commercial Banks in Bangladesh Based on IS (Interest Sensitivity) GAP Analysis :: Science Publishing Group

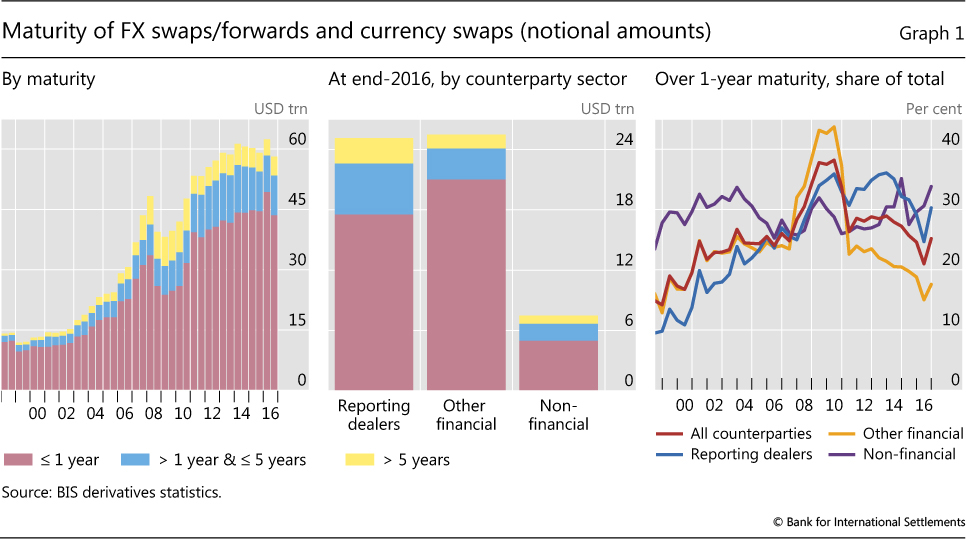

Derivatives in ALM. Financial Derivatives Swaps Hedge Contracts Forward Rate Agreements Futures Options Caps, Floors and Collars. - ppt download

Techniques of asset/liability management: Futures, options, and swaps Outline –Financial futures –Options –Interest rate swaps. - ppt download

1 What is a Difference Between a Forward Contract and a Future Contract | Swap (Finance) | Futures Contract

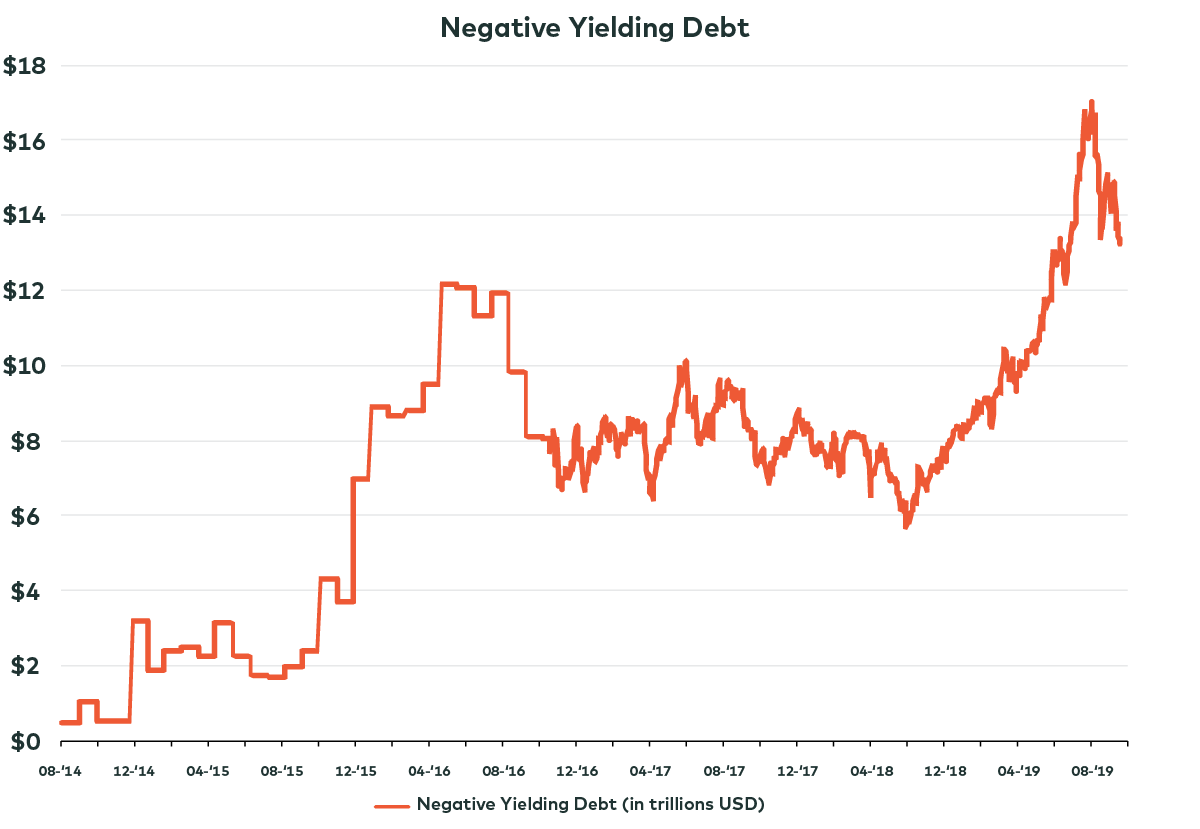

Turning a Negative Into a Positive: Finding Yield Where There Is None Through Currency Hedging | AGF Perspectives

THE USE OF EURODOLLAR FUTURES AND OPTIONS IN SHORT TERM ASSET/LIABILITY MANAGEMENT by M〇K MAN-FAI, MANSFIELD RESEARCH REPORT P

/upgapsidebysidewhitelinesdailystockchartexample-9949280923f341709f3e7f955a25d2a5.jpg)